If you already enjoy the services provided by Smart Cash Management, you can download the Business Digital Banking app. With its service modules you can.

Access your account information

Make transfers between accounts linked to your profile

Deposit checks through your mobile phone 24/7 with Mobile Smart Check1

Approve ACH and wire transactions, and Positive Pay and ACH Positive Pay exceptions

-

Access the Application

-

Balance Reports

-

Internal Transfers

-

Transfer Approvals

-

Mobile Smart Check

Download our app to stay connected to your business anytime and anywhere.

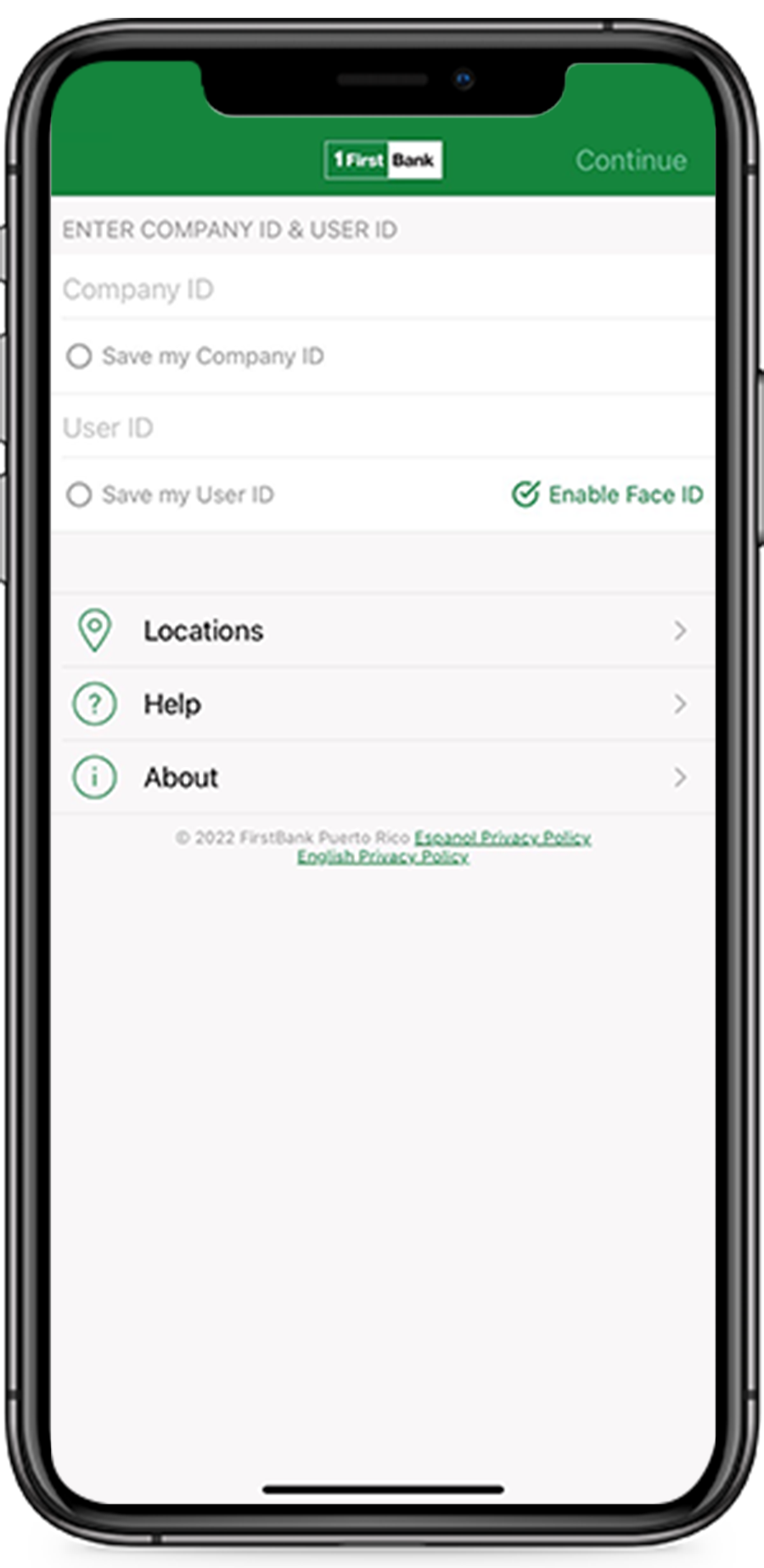

Download the Business Digital Banking app.

Download the Business Digital Banking app.

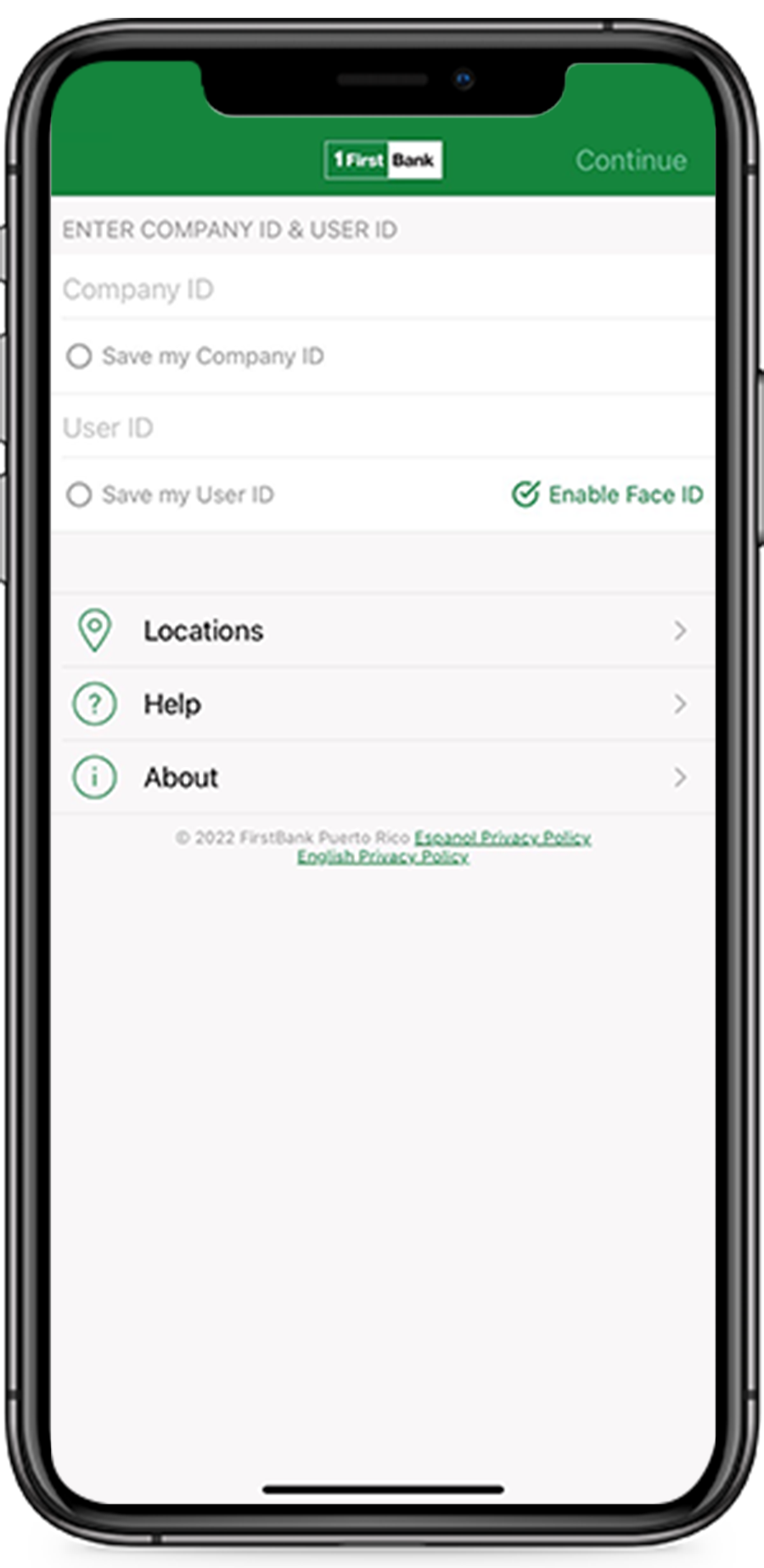

Enter your credentials (Company ID & User ID) on the log-in screen.

Enter your credentials (Company ID & User ID) on the log-in screen.

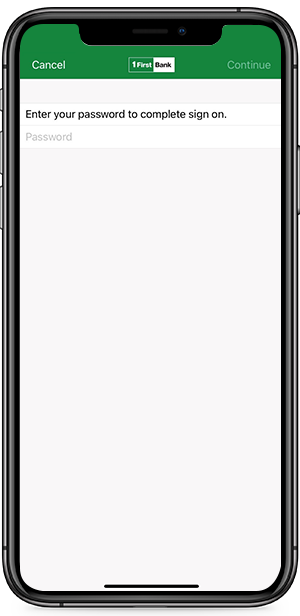

Enter your password.

Enter your password.

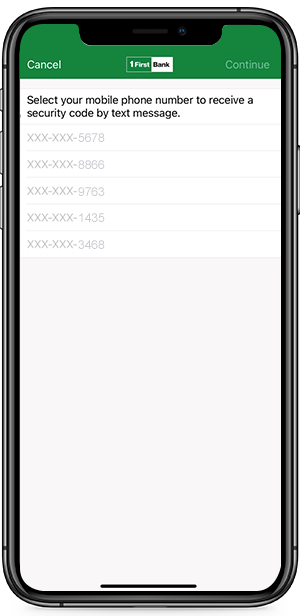

If you are logging in for the first time, enter the telephone number registered in your profile and you will receive a security code.

If you are logging in for the first time, enter the telephone number registered in your profile and you will receive a security code.

Access your account information.

Access your account information.

- 1

- 2

- 3

- 4

- 5

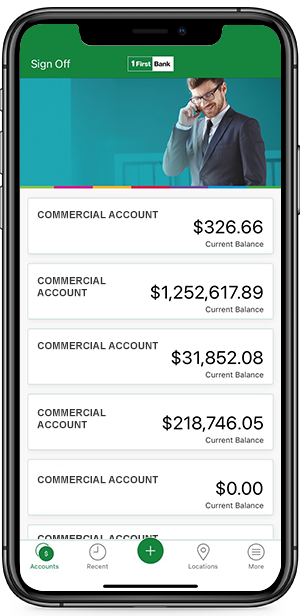

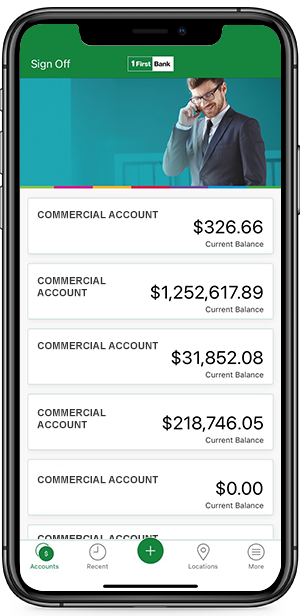

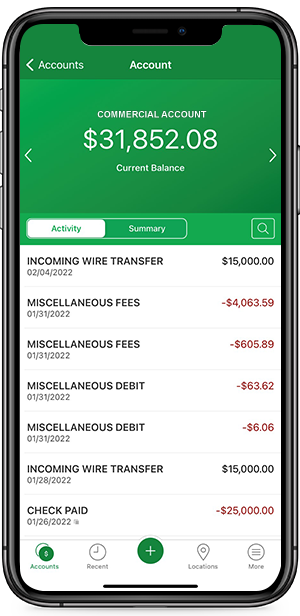

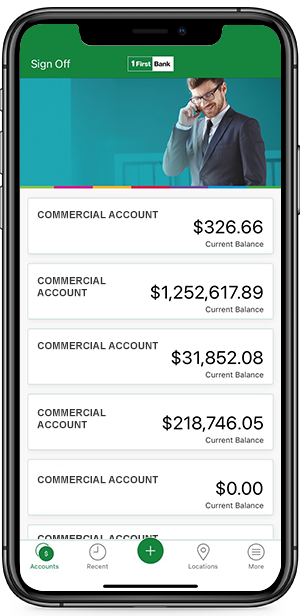

Access your account information.

Log into the mobile app.

Log into the mobile app.

Your account balances will be displayed on the home screen.

Your account balances will be displayed on the home screen.

You can click on any account and see the activity of the last 3 months.

You can click on any account and see the activity of the last 3 months.

- 1

- 2

- 3

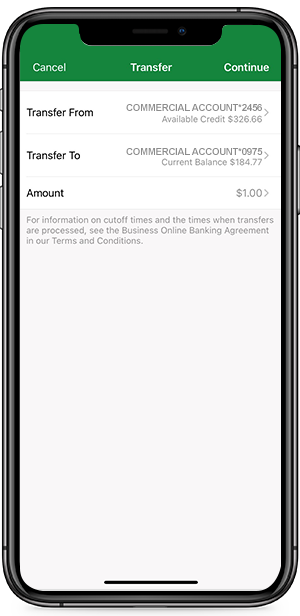

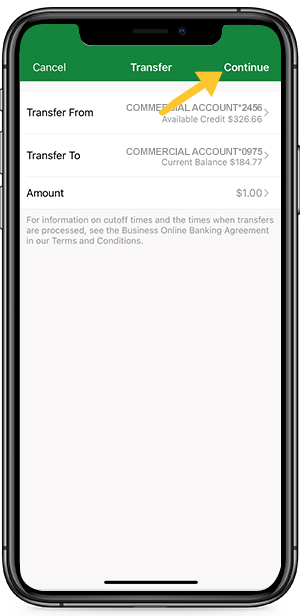

Make transfers between accounts linked to your profile.

Press the Transfer option.

Press the + icon at the bottom of the app and select the Transfer option.

Select the account from which you are going to transfer, the one you wish to credit, and enter the amount to be transferred.

Select the account from which you are going to transfer, the one you wish to credit, and enter the amount to be transferred.

Press Continue and approve the transaction. The app will display a confirmation message.

Press Continue and approve the transaction. The app will display a confirmation message.

- 1

- 2

- 3

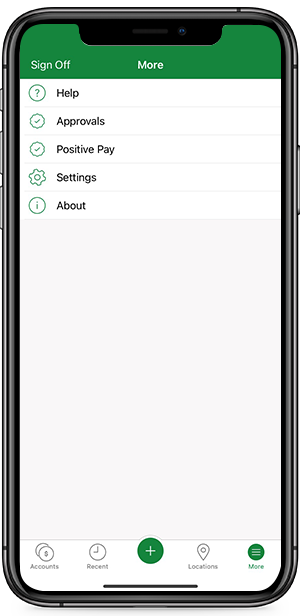

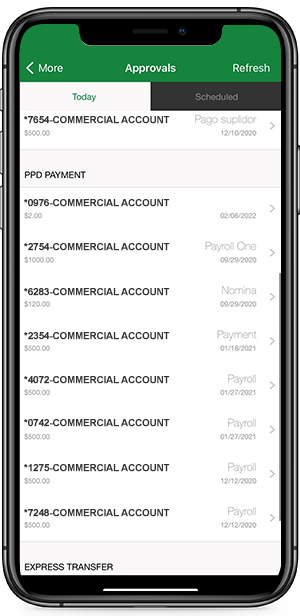

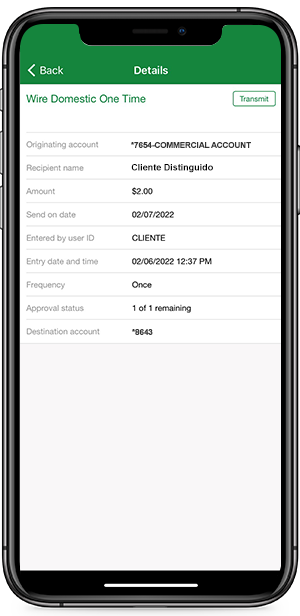

Approve ACH and wire transactions on Positive Pay and ACH Positive Pay exceptions.

Select the Approvals option then select the one approval type.

Select the More option and then Approvals.

The screen will present the transactions pending for approvals.

The screen will present the transactions pending for approvals.

Select the transaction you wish to approve and press Approval *Passcode (Token or OOBA) will be required for approval.

Select the transaction you wish to approve and press Approval *Passcode (Token or OOBA) will be required for approval.

- 1

- 2

- 3

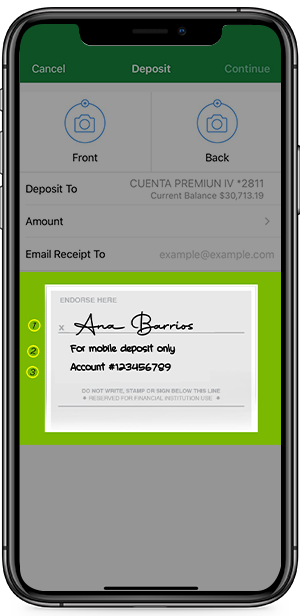

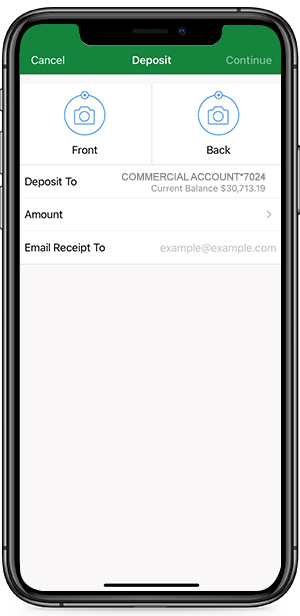

Deposit checks through your mobile phone 24/7 with Mobile Smart Check¹.

Endorse the check and write “For Mobile Deposit Only”. Select Check Deposit and then Deposit a Check.

Endorse the check and write “For Mobile Deposit Only”.

Take a picture of the front and the back of the check, select the account into which you want to deposit it, and confirm the amount.

Take a picture of the front and the back of the check, select the account into which you want to deposit it, and confirm the amount.

Approve the deposit and you will receive an email notification.

Approve the deposit and you will receive an email notification.

- 1

- 2

- 3

Start with a free evaluation.

Call us at 787-729-8290 (option #2)

First Commercial Service Center,

Monday to Friday from 7:30 a.m. to 5:30 p.m.

Member FDIC. Services available only to customers with a FirstBank business account. Clients must be registered in Business Digital Banking as part of the Smart Cash Management Solutions services. Smart Cash Management Solutions services are subject to charges and contracting of additional services. Certain additional terms, costs and conditions may apply. 1The Mobile Smart Check service is subject to eligibility; certain terms and conditions may apply. Deposits made before 6:00 p.m. are processed the same day; deposits made after 6:00 p.m. will be processed the following business day. Deposit limit of $25,000.00 per day and $50,000.00 per month in a 25-day period. Subject to the Funds Availability Policy, Regulation CC.