A Business Analysis Checking account allows you to get better control of your banking relationship.

Consolidate multiple accounts in one statement

Access to over 55,000 Allpoint ATMs nationwide

Competitive earnings credit rate1

Online Banking with multiple user capabilities

e-Statements

Reduce or eliminate service fees2

Telephone Banking

Visa Debit Card

Additional benefits:

-

Flexibility and control over your accounts

-

More reporting - enhanced online options that keep up with the pace of your business

-

Checking that pays for itself - deposit balances earn credits to reduce or offset the cost of banking services

-

Simplify your account management - link multiple accounts and streamline your bookkeeping and service charges

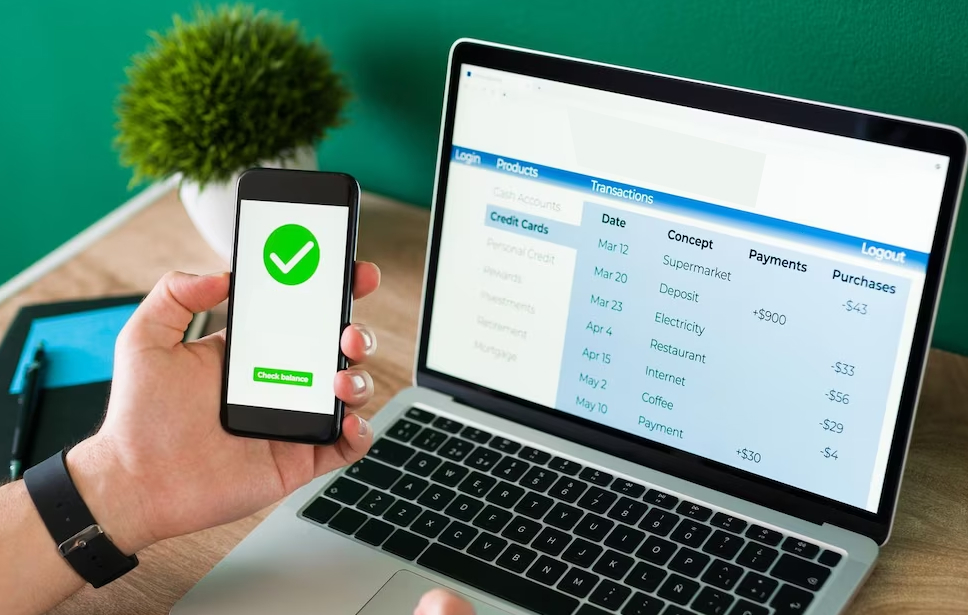

BUSINESS ANALYSIS CHECKING ON YOUR MOBILE

Simplify your life by managing your business checking account with our Business Banking mobile app.

View account balances

Transfer money

Token authentication

View check images

Remotely deposit checks

Real-time alerts

- 1

- 2

- 3

- 4

- 5

- 6

CASH MANAGEMENT SERVICES

With Cash Management Services you gain faster access to working capital, streamline collections and manage payables, with features such as:

Fraud Prevention

Merchant Services

Remote Deposit Capture

HOW TO APPLY

Ready to apply?

Make sure you have the following documents readily available.

In addition to your Social Security card, you will also need one valid photo ID issued by the United States Government, such as:

-

Driver’s License

-

Passport

-

Military ID

-

Government ID

With these documents in hand, visit one of our branches.

FREQUENTLY ASKED QUESTIONS

The Business Analysis checking account will give you control and flexibility of your accounting. It links multiple accounts and users to help you simplify the bookkeeping. By combining multiple accounts, you can earn more and lower your fees.

Yes, you can consolidate multiple accounts and have multiple users with online banking.

The minimum requirement is only $100 to open the account.

Member FDIC. All products and services are subject to Terms and Conditions. Minimum deposit of $100 required to open account. 1 Earnings Credit Rate varies and is applied to average collected balances. 2 Monthly maintenance fee: $15.00. Checks paid: $0.15. Deposit Tickets: $0.30. Deposited Item: $0.10. Cash deposits $0.10 for every 100 over $20,000 per month.

FirstBank Florida is a division of FirstBank Puerto Rico. Product and services available only in Florida.