If you are ready to start the buying process or need assistance with a pre-qualification call us today at at 340-775-4663

If you need help with guidance, buying your first home or refinancing, leave us your information here.

FirstBank is a proud participating lender of the VI Slice Program3 and our mortgage experts are ready to help you acquire your first home.

Take the first steps towards your dream home.

-

Buy my first home

-

Refinance my home

-

Apply for a mortgage loan

-

Manage my mortgage

Buying your first home is an important milestone

Here we tell you all the information you need in order to make the right decision.

Is it the right time to buy a house?

Before making the decision, you should consider if it is the right time to buy a house. Know your purchasing and loan payment capacity with the following steps:

-

Check your credit score and history

-

Determine the area where you want to live

-

Make a list of preferences and organize them by priority

-

Know your budget

-

Arrange an initial interview with your Mortgage Consultant and get an orientation on the different financing alternatives

What savings do you have?

Evaluate your savings and determine if they are sufficient to buy the property you want. Typically you should have 10% to 15% of the sales price saved to cover closing costs and/or option if required.

What is your monthly income?

Some examples of income that you can use for qualification are base salary, overtime, pensions, among others. Such income should be stable for a minimum of two years and should have a good chance of continuing to be received.

How important is it for me to have my own home?

While the view, decoration, location, and not feeling tied-down may be important for some people, others feel it is much more important to have a home of their own. Determine what is important for you, and if it is having your own home, we are here!

Benefits of paying a mortgage vs. renting

-

When you rent, you pay your landlord's mortgage. As a homeowner, you pay your own mortgage and invest your money in your future capital asset.

-

With good interest and financing offers, your mortgage payment may be less than your rental payment.

-

You can fix up the house to your liking and make the improvements or additions you want.

-

Benefit from federal, state and municipal government incentive programs to subsidize the financing of your primary residence.

-

When you buy a property, you are creating home equity.

-

It is an investment in your and your family's future.

-

The interest you pay on the mortgage can be deducted from your tax return.

-

You avoid uncertainties related to contract duration, monthly payment increase, or contract renewal.

Refinance my home

When you refinance your mortgage, a new loan replaces your current one.

Things to keep in mind when refinancing.

It is important to know the approximate value of your property and the current debt of your home in order to evaluate any alternatives that meet your needs.

What are some things the bank takes into consideration during the process?

As part of the process, clients should know that income, credit history, the accumulated capital of the property, the difference between the current mortgage’s interest rate and the new interest rate, and the cost of refinancing.

That’s why it is important to select the best product for your specific needs.

-

Making improvements

-

Consolidating debt – improve your financial stability

-

Reducing the term

-

Increasing the term in order to lower your payment

-

Reducing the interest rate

Each case is unique. That is why we recommend you request an orientation. Together we can analyze the best option for your specific needs.

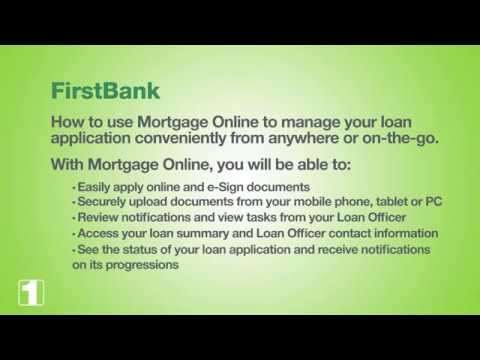

Apply for a mortgage loan

Ready to apply for your mortgage online?

Start now from the comfort of your home, with all the information readily available and without having to go to the bank!

All you need is a computer, tablet, or mobile phone with an internet connection.

Get to know the benefits of applying for your loan online:

-

Enjoy 24/7 online access

-

Upload and review documents from your personal computer, smartphone or tablet in a secure platform, by taking and uploading a photo or scanning it

-

Choose the eConsent option for a total digital experience throughout the process

-

Electronically sign (eSign) to receive and upload disclosures and documents

-

Get real-time notifications on the status of your loan

-

Easily locate your Loan Officer’s contact information

-

Feel confident that your personal information is in a certified Secure Sockets Layer (SSL) site

-

Get to know the mortgage loan product alternatives that we offer so you can analyze and compare them

-

Find your application summary

-

Review all your loan application details

-

Receive notifications from your Loan Officer regarding your application

-

Easily identify all application tasks so that you can complete them and expedite the process

-

Access a list to view all documents that have been uploaded to the system

Subject to credit approval. Certain terms and conditions apply.

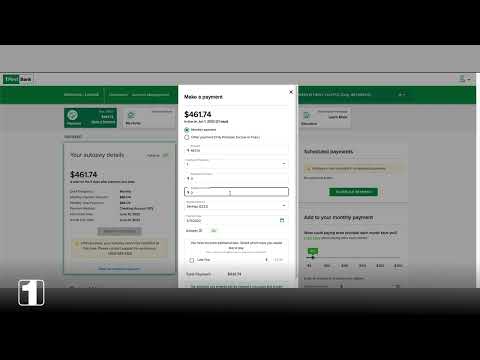

Manage my FirstBank mortgage loan

Manage your loan from the comfort of your home. All you need is to register.

Access our services to manage your FirstBank loan mortgage. Receive your digital statements by giving electronic consent.

Download the following available documents 24/7.

Accessible documents include:

-

Annual mortgage interest statement, 480.7A/ 1098

-

Letters regarding your mortgage loan

-

Monthly Statement

-

Escrow Statement

-

ARM (Interest Change Notice)

-

Request copies of documents

Payments:

-

Pay and schedule your monthly payments electronically

-

Request mortgage assistance or loss mitigation program

-

Request payment slips

All about your mortgage:

-

Verify payment history

-

View payments made from reserve account for insurance and contributions

-

Obtain principal balance

-

View and request amortization tables

Manage your FirstBank mortgage loan in the most convenient and easy way for you.

Subject to credit approval. Certain terms and conditions may apply.

Buying your first home is an important milestone

Here we tell you all the information you need in order to make the right decision.

Is it the right time to buy a house?

Before making the decision, you should consider if it is the right time to buy a house. Know your purchasing and loan payment capacity with the following steps:

Buying your first home is an important milestone. Here we tell you all the information you need in order to make the right decision.

Is it the right time to buy a house?

Before making the decision, you should consider if it is the right time to buy a house. Know your purchasing and loan payment capacity with the following steps:

-

Check your credit score and history

-

Determine the area where you want to live

-

Make a list of preferences and organize them by priority

-

Know your budget

-

Arrange an initial interview with your Mortgage Consultant and get an orientation on the different financing alternatives

What savings do you have?

Evaluate your savings and determine if they are sufficient to buy the property you want. Typically you should have 10% to 15% of the sales price saved to cover closing costs and/or option if required.

What is your monthly income?

Some examples of income that you can use for qualification are base salary, overtime, pensions, among others. Such income should be stable for a minimum of two years and should have a good chance of continuing to be received.

How important is it for me to have my own home?

While the view, decoration, location, and not feeling tied-down may be important for some people, others feel it is much more important to have a home of their own. Determine what is important for you, and if it is having your own home, we are here!

-

When you rent, you pay your landlord's mortgage. As a homeowner, you pay your own mortgage and invest your money in your future capital asset.

-

With good interest and financing offers, your mortgage payment may be less than your rental payment.

-

You can fix up the house to your liking and make the improvements or additions you want.

-

Benefit from federal, state and municipal government incentive programs to subsidize the financing of your primary residence.

-

When you buy a property, you are creating home equity.

-

It is an investment in your and your family's future.

-

The interest you pay on the mortgage can be deducted from your tax return.

-

You avoid uncertainties related to contract duration, monthly payment increase, or contract renewal.

Refinance my home

When you refinance your mortgage, a new loan replaces your current one.

Things to keep in mind when refinancing.

It is important to know the approximate value of your property and the current debt of your home in order to evaluate any alternatives that meet your needs.

What are some things the bank takes into consideration during the process?

As part of the process, clients should know that income, credit history, the accumulated capital of the property, the difference between the current mortgage’s interest rate and the new interest rate, and the cost of refinancing.

That’s why it is important to select the best product for your specific needs.

-

Making improvements

-

Consolidating debt – improve your financial stability

-

Reducing the term

-

Increasing the term in order to lower your payment

-

Reducing the interest rate

Each case is unique. That is why we recommend you request an orientation. Together we can analyze choose the best option for your specific needs.

Apply for a mortgage loan

Ready to apply for your mortgage online?

Start now from the comfort of your home, with all the information readily available and without having to go to the bank!

All you need is a computer, tablet, or mobile phone with an internet connection.

What to do after your application is closed:

-

Closing Department

Your loan will go to a closing officer, who will do a final revision, prepare the documents, and coordinate with all parties involved.

-

Closing Disclosure

You will receive a document detailing the loan terms, closing expenses, and closing cost contributions (if applicable). Make sure to clarify any doubts with your officer.

-

Closing

After reviewing and accepting the terms and conditions, you will be able to arrange the closing three (3) days after receiving the Closing Disclosure.

Manage my FirstBank mortgage loan

Are you a FirstMortgage customer?

Manage your loan from the comfort of your home. All you need is register.

Access our services to manage your FirstBank loan mortgage. Receive your digital statements just by giving electronic consent.

Download the following available documents 24/7.

Accessible documents include:

-

Annual mortgage interest statement, 480.7A/ 1098

-

Letters regarding your mortgage loan

-

Monthly Statement

-

Escrow Statement

-

ARM (Interest Change Notice)

-

Request copies of documents

Payments

-

Pay and schedule your monthly payments electronically

-

Request mortgage assistance or loss mitigation program

-

Request payment slips

All about your mortgage

-

Verify payment history

-

View payments made from reserve account for insurance and contributions

-

Obtain principal balance

-

View and request amortization tables

Manage your FirstBank mortgage loan in the most convenient and easy way for you.

LEGAL USVI

Subject to credit approval. Certain terms and conditions may apply.

Buying your first home is an important milestone

Here we tell you all the information you need in order to make the right decision.

Is it the right time to buy a house?

Before making the decision, you should consider if it is the right time to buy a house. Know your purchasing and loan payment capacity with the following steps:

-

Check your credit score and history

-

Determine the area where you want to live

-

Make a list of preferences and organize them by priority

-

Know your budget

-

Arrange an initial interview with your Mortgage Consultant and get an orientation on the different financing alternatives

What savings do you have?

Evaluate your savings and determine if they are sufficient to buy the property you want. Typically you should have 10% to 15% of the sales price saved to cover closing costs and/or option if required.

What is your monthly income?

Some examples of income that you can use for qualification are base salary, overtime, pensions, among others. Such income should be stable for a minimum of two years and should have a good chance of continuing to be received.

How important is it for me to have my own home?

While the view, decoration, location, and not feeling tied-down may be important for some people, others feel it is much more important to have a home of their own. Determine what is important for you, and if it is having your own home, we are here!

Benefits of paying a mortgage vs. renting

-

When you rent, you pay your landlord's mortgage. As a homeowner, you pay your own mortgage and invest your money in your future capital asset.

-

With good interest and financing offers, your mortgage payment may be less than your rental payment.

-

You can fix up the house to your liking and make the improvements or additions you want.

-

Benefit from federal, state and municipal government incentive programs to subsidize the financing of your primary residence.

-

When you buy a property, you are creating home equity.

-

It is an investment in your and your family's future.

-

The interest you pay on the mortgage can be deducted from your tax return.

-

You avoid uncertainties related to contract duration, monthly payment increase, or contract renewal.

Refinance my home

When you refinance your mortgage, a new loan replaces your current one.

Things to keep in mind when refinancing.

It is important to know the approximate value of your property and the current debt of your home in order to evaluate any alternatives that meet your needs.

What are some things the bank takes into consideration during the process?

As part of the process, clients should know that income, credit history, the accumulated capital of the property, the difference between the current mortgage’s interest rate and the new interest rate, and the cost of refinancing.

That’s why it is important to select the best product for your specific needs.

-

Making improvements

-

Consolidating debt – improve your financial stability

-

Reducing the term

-

Increasing the term in order to lower your payment

-

Reducing the interest rate

Each case is unique. That is why we recommend you request an orientation. Together we can analyze choose the best option for your specific needs.

Apply for a mortgage loan

Ready to apply for your mortgage online?

Start now from the comfort of your home, with all the information readily available and without having to go to the bank!

All you need is a computer, tablet, or mobile phone with an internet connection.

Get to know the benefits of applying for your loan online:

-

Enjoy 24/7 online access

-

Upload and review documents from your personal computer, smartphone or tablet in a secure platform, by taking and uploading a photo or scanning it

-

Choose the eConsent option for a total digital experience throughout the process

-

Electronically sign (eSign) to receive and upload disclosures and documents

-

Get real-time notifications on the status of your loan

-

Easily locate your Loan Officer’s contact information

-

Feel confident that your personal information is in a certified Secure Sockets Layer (SSL) site

-

Get to know the mortgage loan product alternatives that we offer so you can analyze and compare them

-

Find your application summary

-

Review all your loan application details

-

Receive notifications from your Loan Officer regarding your application

-

Easily identify all application tasks so that you can complete them and expedite the process

-

Access a list to view all documents that have been uploaded to the system

Subject to credit approval. Certain terms and conditions apply.

Are you a FirstMortgage customer?

Manage your loan from the comfort of your home. All you need is register.

Access our services to manage your FirstBank loan mortgage. Receive your digital statements just by giving electronic consent.

Download the following available documents 24/7. Accessible documents include:

-

Annual mortgage interest statement, 480.7A/ 1098

-

Letters regarding your mortgage loan

-

Monthly Statement

-

Escrow Statement

-

ARM (Interest Change Notice)

-

Request copies of documents

Payments

-

Pay and schedule your monthly payments electronically

-

Request mortgage assistance or loss mitigation program

-

Request payment slips

All about your mortgage

-

Verify payment history.

-

View payments made from reserve account for insurance and contributions.

-

Obtain principal balance.

-

View and request amortization tables.

Manage your FirstBank mortgage loan in the most convenient and easy way for you.

*Subject to credit approval. FirstMortgage is a division of FirstBank Puerto Rico.

Contact Us

CALCULATOR

Find the payment that best fits your needs with our mortgage calculator.

Estimate monthly payment

*The results provided by this calculator are only for illustrative purposes. They are based on the information provided and do not constitute a pre-qualification. The estimated monthly payment is for principal and interest only and does not include other monthly payments such as property insurance, mortgage insurance, flood insurance or property taxes.

INTEREST RATES

Weekly offers for FHA and Conventional Loans

-

FHA 30 years¹

-

Conv NonConforming 30yrs²

| Interest Rate |

APR

|

Amount

|

Monthly Payment

|

|---|---|---|---|

| 5.750% | 6.61% |

$150,000 |

$876 |

| Interest Rate |

APR

|

Amount

|

Monthly Payment

|

|---|---|---|---|

| 5.875% | 6.15% |

$150,000 |

$888 |

The monthly payment disclosed is for principal and interest only and does not include other monthly payments such as property insurance, mortgage insurance, flood insurance or property taxes. All offers, types, terms and conditions of the mortgage loans are subject to credit approval. For loan applications originating from February 23, 2026 through February 28, 2026. After this date, the interest rate may change according to market conditions until the loan application is approved. See more.

MORTGAGE LOANS

This type of loan is ideal for those who are looking to buy their first home, since it lets you finance up to 96.5% of the selling price or property value, whichever is the lowest, up to the maximum loan amount allowed by the district - established by the Federal Housing Administration (FHA).

This federal guarantee offers multiple advantages and protections during the term of the loan, which minimizes the down payment, interests, and closing expenses. In addition, the FHA offers many options to help you keep your property and avoid foreclosure.

This type of loan is ideal for buying or refinancing one-to-four-unit primary residences, investment properties, and second homes. You can finance up to 80% of the property and maintain the same interest rate for the life of your mortgage loan.

If you are a veteran of the armed forces, a widow of a veteran, or an eligible member of the National Guard or the Reserve, this loan is for you. You can finance up to 100% of the property value or the sales price, whichever is the lowest (applies to the home purchase). This loan is issued via the Department of Veteran’s Affairs (VA) and can be used for buying or refinancing your principal residence.

-

FHA Loan

-

Fixed Rate Loan

-

Veteran Administration Loan

-

Rural Development Loan

FHA Loan

This type of loan is ideal for those who are looking to buy their first home, since it lets you finance up to 96.5% of the selling price or property value, whichever is the lowest, up to the maximum loan amount allowed by the district - established by the Federal Housing Administration (FHA).

This federal guarantee offers multiple advantages and protections during the term of the loan, which minimizes the down payment, interests, and closing expenses. In addition, the FHA offers many options to help you keep your property and avoid foreclosure.

Fixed Rate Loan

This type of loan is ideal for buying or refinancing one-to-four-unit primary residences, investment properties, and second homes. You can finance up to 80% of the property and maintain the same interest rate for the life of your mortgage loan.

Veteran Administration Loan

If you are a veteran of the armed forces, a widow of a veteran, or an eligible member of the National Guard or the Reserve, this loan is for you. You can finance up to 100% of the property value or the sales price, whichever is the lowest (applies to the home purchase). This loan is issued via the Department of Veteran’s Affairs (VA) and can be used for buying or refinancing your principal residence.

Rural Development Loan

This loan is part of a program of mortgage insurance loans administered by the Department of Agriculture of the United States, established to help moderate-income families acquire their main homes. With this loan, you could finance up to 100% of the property value based on the appraisal for the purchase of the main residence. The subject property must be in a geographical area as per the USDA eligibility map.

HOW TO APPLY

Ready to buy or refinance your home?

Applying is easy with Mortgage Online. Start your mortgage application from anywhere. For information on rates & terms, call us at 340-775-4663, email us at vimortgage@firstbankpr.com or visit a Branch.

Create your account and make sure you have the following required documents:

-

Property information

-

Personal information

Identify pending tasks in your application.

Upload and review documents from your computer, mobile phone or tablet.

Receive real-time notifications about the status of your loan application.

Contact us at 1-340-775-4663. You can also contact your Loan Officer, email us at vimortgage@firstbankpr.com or visit a Branch.

FREQUENTLY ASKED QUESTIONS

Knowing how much you are able to pay has a lot to do with your Debt-To-Income (DTI) ratio. This is the percentage of your gross income that goes towards paying debts.

For example, if your gross family income per month is $5,200 and the monthly debt payments amount to $1,200, the DTI would be calculated by dividing your monthly debt by your monthly gross income: $1,200 / $5,200 = 0.23 This means your DTI is 23%. As a rule, we recommend the percentage to be 43% or less. Nonetheless, depending on your profile, you may qualify for other products that allow for a DTI over 43%. Your new monthly mortgage payment (PITI) for the subject mortgage transaction will also be included in the debts.

To evaluate a mortgage loan, the debts included in your credit profile/credit references are taken into account. This includes revolving accounts, personal loans, auto loans, student loans (if applicable); as well as debt outside of the credit report, such as rent and maintenance payments, taxes (for other properties), and child support.

As a rule of thumb, lenders require two years of employment to qualify for a home loan. Your job history is just one of several criteria underwriters will check when you buy a home or refinance an existing mortgage. You may qualify to purchase or refinance your home if you meet certain requirements, you are permanent in your job, you can present evidence of the last 24 months (as of the day the application is submitted) that you were studying/working in the same field, and if the income is not from self-employment.

Yes, it is possible to buy a house without credit, there are options available that consider alternative credit. This means monthly payments and expenses such as rent, water, electricity, furniture, and utilities. You must furnish a payment history certification for the last 12 months. FHA loans with nontraditional credit or manual underwriting may be worthwhile strategies for buying a home with no credit. However, building credit can improve your mortgage loan options.

Your Loan-To-Value (LTV) ratio describes how much money you owe on the house compared to the appraised value of the property. You can find your LTV by dividing your mortgage amount by the house’s appraised value or selling price, whichever is less. The LTV varies according to the investor, transaction type, whether it is a sale or refinancing, and the use to be given to the property.

For example, imagine you are buying a home whose selling price or appraised value is $100,000. If your down payment is 20% ($20,000), your bank will loan you the remaining $80,000. Therefore, your LTV is 80%. The main advantage of a higher down payment is that it helps you obtain a lower interest rate and make your monthly payments lower. Above 80% on several products requires private mortgage insurance (if applicable).

Yes, you may receive donations to cover part of the down payment and closing costs. If you have a relative that wants to help you purchase your home, they may contribute to your closing costs or initial down payment. Documentation will be required to validate the source of the donations. Please keep in mind that these requirements may vary by loan type and the use of the property you want to buy because is only for your main residence or second home, donations are not allowed in investment properties.

The monthly payment disclosed is for principal and interest only and does not include other monthly payments such as property insurance, mortgage insurance, flood insurance or property taxes. All offers, types, terms and conditions of the mortgage loans are subject to credit approval. For loan applications originating from February 23, 2026 through February 28, 2026. After this date, the interest rate may change according to market conditions until the loan application is approved. Once the loan application is approved, you will have 30 calendar days to close the transaction. If the transaction does not close within the 30-day period, the interest rate could change. Loan amount from $75,000 to $2,000,000. 1. Offer for loans insured by the Federal Housing Administration (FHA) from $75,000 to the established limit for each municipality, with a maximum of 96.5% of purchase price or appraisal (LTV), whatever is lowest for the sale of a new or existing home. For refinance without surplus up to a maximum of 97.75% and for refinance with surplus up to 80%. This product requires FHA mortgage insurance. For an FHA 30-year loan 0.250% under the prevailing interest will be honored at closing time. 2. Offers for conventional non-conforming loans from $75,000 to $832,750 apply up to 85% LTV, $832,750 to $1,000,000 apply up to 80% LTV and from $1,000,000 to $2,000,000 apply up to 70% LTV, for primary residence according to compensating factor, use and loan amount. Additional costs apply for refinancing. For a conventional non-conforming 30-year loan 0.625% under the prevailing interest will be honored at closing time. 3. The VI Slice program is administered by the Virgin Islands Economic Development Authority (VIEDA), in partnership with the Office of the Governor and the Office of Disaster Recovery. Applicant must meet all the eligibility requirements for the VI Slice Program. Offers are subject to the delivery of requested documents and credit approval according to parameters established under FirstMortgage and the Federal Housing Administration. Subsequent offers may invalidate these offers. Other conditions apply according to the criteria established by FirstMortgage. For loans over $2,000,000 or when the property is in a condominium, other offers apply. Certain restrictions apply. FirstMortgage is a division of FirstBank Puerto Rico. FirstBank is an FDIC Member: Equal Housing Lender.